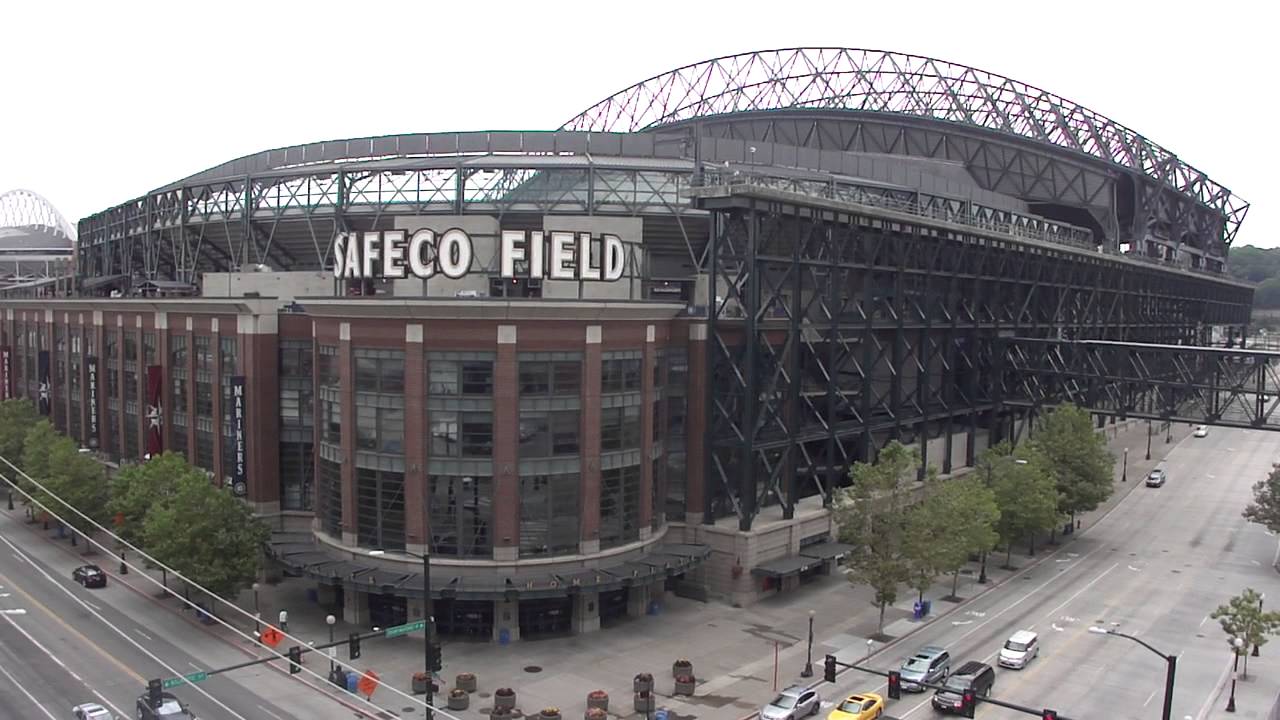

Safeco Insurance, a prominent name in the insurance industry, offers a wide array of coverage options that cater to the diverse needs of individuals and businesses. This article delves into the history, products, customer service, and reputation of Safeco, providing a thorough understanding of what this company brings to the insurance market.

History of Safeco Insurance

Safeco Insurance was founded in 1923 in Seattle, Washington, by a group of insurance professionals who aimed to provide affordable and reliable insurance solutions. Originally named the “Safeco Title Insurance Company,” the organization expanded rapidly, establishing itself as a significant player in the property and casualty insurance sector. In 1961, Safeco went public, which helped fuel its growth and expand its offerings.

In 1998, Safeco acquired the American States Insurance Company, further solidifying its presence in the insurance market. This strategic acquisition allowed Safeco to broaden its product line and enhance its capabilities in serving customers across the nation. Over the years, Safeco has been recognized for its innovative approach to insurance, which has helped it adapt to the changing needs of policyholders.

Products and Services Offered by Safeco

Safeco Insurance offers a comprehensive range of insurance products designed to meet the needs of both individuals and businesses. The primary offerings include:

1. Auto Insurance

Safeco’s auto insurance policies are designed to provide coverage for various needs, including:

- Liability Coverage: Protects against claims for bodily injury and property damage resulting from an accident.

- Collision Coverage: Covers damage to the policyholder’s vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Offers protection against non-collision-related incidents, such as theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects against losses if the policyholder is involved in an accident with a driver who has insufficient or no insurance.

2. Homeowners Insurance

Safeco’s homeowners insurance provides financial protection for homeowners in the event of damage or loss to their property. Key features include:

- Dwelling Coverage: Covers the structure of the home against damages from covered perils such as fire, wind, and hail.

- Personal Property Coverage: Protects personal belongings within the home, including furniture, electronics, and clothing.

- Liability Coverage: Provides protection against claims resulting from injuries or damages occurring on the policyholder’s property.

- Additional Living Expenses: Covers the costs of temporary housing if the home becomes uninhabitable due to a covered loss.

3. Renters Insurance

For those who rent their living spaces, Safeco offers renters insurance that covers personal property and liability. This coverage is crucial for individuals who want to protect their belongings from theft or damage.

4. Business Insurance

Safeco provides a variety of commercial insurance products to protect businesses, including:

- General Liability Insurance: Protects businesses against claims of bodily injury, property damage, and personal injury.

- Commercial Property Insurance: Covers damage to business property, including buildings, equipment, and inventory.

- Workers’ Compensation Insurance: Offers coverage for employees who are injured on the job, ensuring they receive medical care and wage replacement.

5. Specialty Insurance

Safeco also offers specialty insurance products to cover unique needs, such as motorcycle insurance, boat insurance, and classic car insurance. These policies provide tailored coverage for vehicles that may not fit into standard insurance categories.

Customer Service and Support

Safeco is dedicated to providing exceptional customer service, which is crucial in the insurance industry. The company offers various resources to assist policyholders, including:

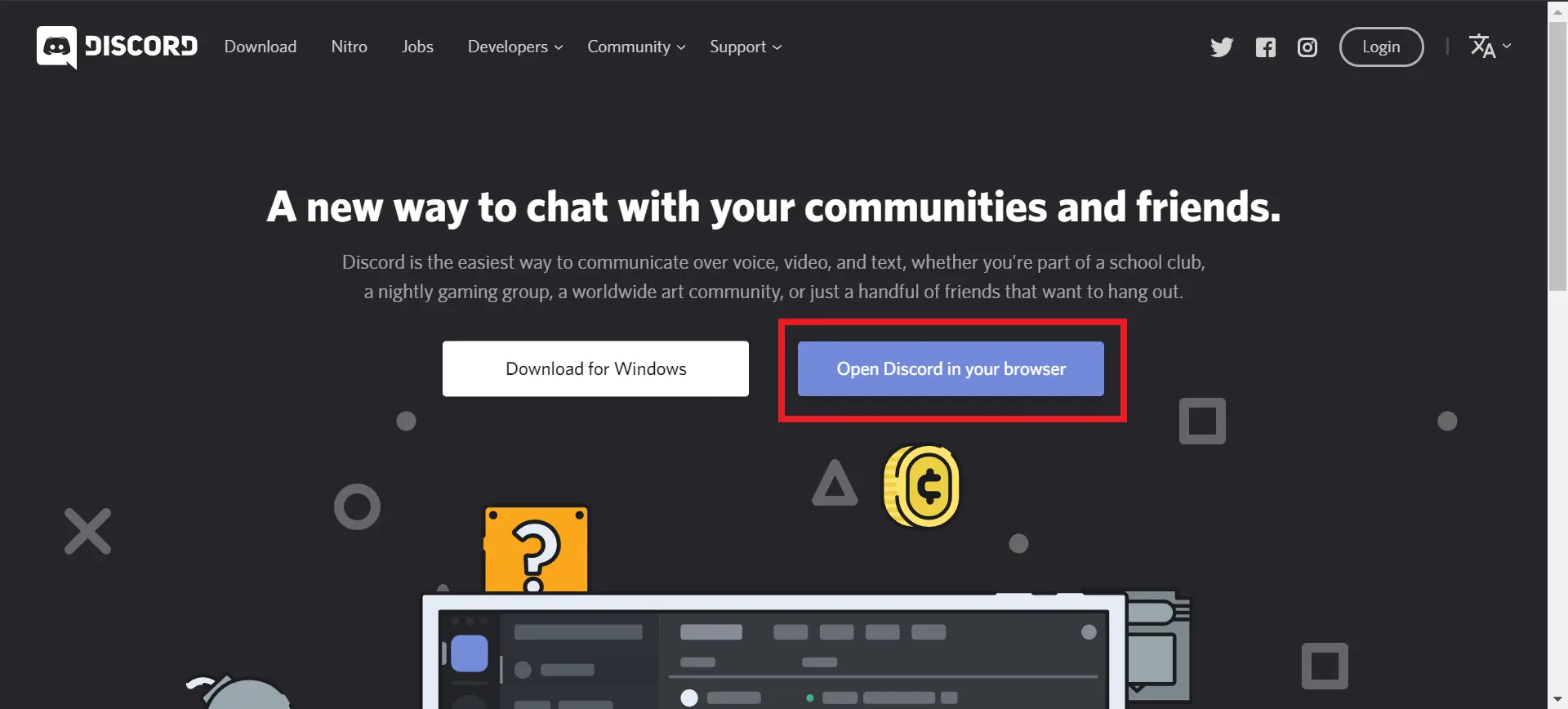

1. Online Account Management

Policyholders can easily manage their accounts online through Safeco’s user-friendly website. This platform allows customers to:

- View policy details

- Make payments

- File claims

- Update personal information

2. Claims Process

Safeco understands that filing a claim can be a stressful experience. To streamline the process, the company offers an online claims portal and a mobile app, enabling customers to file claims quickly and efficiently. Their claims representatives are available to guide policyholders through the process, ensuring that claims are handled promptly and fairly.

3. 24/7 Support

Safeco provides 24/7 customer support, allowing policyholders to get assistance whenever they need it. Whether it’s a question about a policy or help with filing a claim, customers can reach out to Safeco’s support team at any time.

Reputation and Financial Stability

Safeco Insurance has built a strong reputation over the years for providing quality insurance products and excellent customer service. The company has received positive ratings from various industry analysts and consumer organizations.

1. Financial Ratings

Safeco is part of the Liberty Mutual Group, which has consistently received high ratings from financial assessment agencies. The company’s financial strength is a critical factor in its ability to pay claims, making it a reliable choice for consumers.

2. Customer Satisfaction

Customer satisfaction ratings for Safeco are generally positive. Policyholders appreciate the comprehensive coverage options and the accessibility of customer service. Many customers report a smooth claims process and prompt resolution of their issues.

3. Community Engagement

Safeco is committed to giving back to the communities it serves. The company engages in various charitable initiatives and partnerships that support education, safety, and disaster relief efforts. This commitment to social responsibility enhances its reputation and strengthens customer loyalty.

Discounts and Savings

Safeco offers a variety of discounts to help policyholders save on their insurance premiums. Some of the available discounts include:

- Multi-Policy Discount: Customers who bundle multiple insurance policies, such as auto and home insurance, can enjoy significant savings.

- Safe Driver Discount: Policyholders with a clean driving record may qualify for discounts based on their safe driving habits.

- Home Safety Discounts: Installing security systems, smoke detectors, and other safety features in the home can lead to premium reductions.

- Good Student Discount: Young drivers who maintain a high GPA may qualify for discounts on their auto insurance.

These discounts make Safeco a competitive option for those looking to save on their insurance premiums while still receiving quality coverage.

Conclusion

In summary, Safeco Insurance stands out as a reputable provider of a wide range of insurance products, from auto and homeowners insurance to specialty coverage for unique needs. With a strong history, commitment to customer service, and a focus on community engagement, Safeco has established itself as a leader in the insurance industry. Policyholders benefit from comprehensive coverage options, financial stability, and various discounts, making Safeco a compelling choice for individuals and businesses seeking reliable insurance solutions.